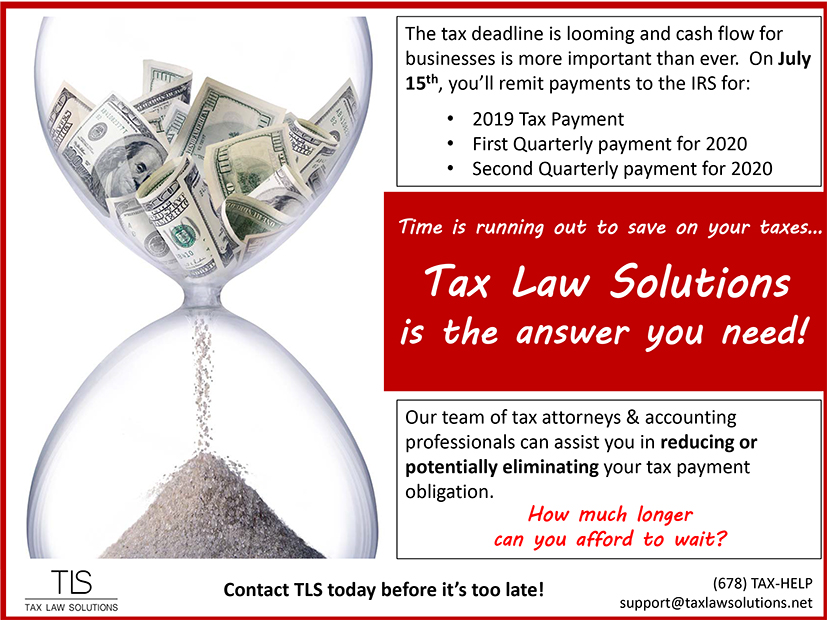

Effective tax planning can significantly reduce the “triple-whammy” of tax payments all simultaneously due on July 15: for 2019 taxes, 2020 first quarter estimated taxes, and 2020 second quarter estimated taxes. By reducing those payments, business owners can preserve cash that may be vital for their ongoing business operations. TLS has been doing this for thousands of business owner clients for 15 years.

Continue reading “How effective tax planning reduces quarterly tax payments”