WHO WE ARE

We are a team of tax experts, accountants, and business strategists that design comprehensive and customized solutions that enables our clients to dramatically and permanently reduce their taxes.

WHAT WE DO

If you’re frustrated with your current tax situation, we can help you significantly reduce your tax liability! We offer a comprehensive approach to tax planning that considers your business operation, cash flows, competitive environment, future years projected profitability and your personal situation. We don’t sell products, we sell advanced tax planning solutions and business solutions to dramatically reduce your taxes.

We’ve structured more than 6,000 tax plans tailored to our client’s business and personal situations. TLS fully implements all of the tax plans we design and recommend. We will work with you, your CPA, and your advisors during the implementation phase to guide you through each decision and step of your plan. We help our clients with tax plans that are:

- IRS compliant

- Permanent and offer dramatic results

- Proven and tested

- Lifestyle changing

- Easy to implement

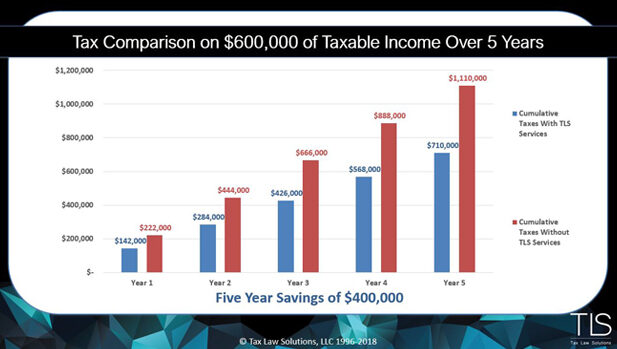

On average we reduce our clients taxes by 30% – 40%

This model is for illustrative purposes only, and is not a guarantee or predictor of actual taxes.

Who We Work With

We have designed plans for business owners across multiple industries including:

- Construction

- Manufacturing

- Distribution

- Consumer goods

- Financial Advisors

- Physicians

- Service Providers

- Transportation

- Real Estate

- Environmental

- Franchise Companies

- Investments firms

- Legal firms

- Medical devices

- Software Developers

- Oil & Gas

- Medical devices

- Software Developers

- Oil & Gas

Questions? Check out our FAQ page.

See If You Qualify.

Take one-minute to answer a few questions to see if you qualify for our complimentary, comprehensive tax analysis. It’s completely risk free, you have nothing to lose.

Our Clients Get Results!

“TLS reduced my taxes by $86,000 in the first year! They provided excellent service throughout the entire process and measurable results beyond what I thought possible. The strategies have positioned me for an early retirement should I so choose, created a more efficient corporate structure and above all else financial security for my family.”

Jared | South Carolina

Why Haven't I Heard of This?

Sometimes it really is about knowing the right people – in tax planning or in any other skilled profession. Because we are extremely narrow in our focus, we are also deep in our knowledge and understanding of tax planning for business owners. CPAs typically do tax reporting, not forward tax planning and analysis. Contact us today for more information.